In recent years, copy trading forex https://fx-trading-uz.com/ has gained significant attention among investors looking for ways to diversify their portfolios while minimizing risks. This innovative trading method allows individuals to follow and replicate the trades of successful traders, bringing the world of Forex closer to both novices and seasoned investors. Understanding the dynamics, benefits, and critical strategies of copy trading can help individuals make informed decisions and harness the potential of this trading style. In this article, we will explore the essential aspects of copy trading in Forex, enabling you to leverage this investment strategy confidently.

What is Copy Trading?

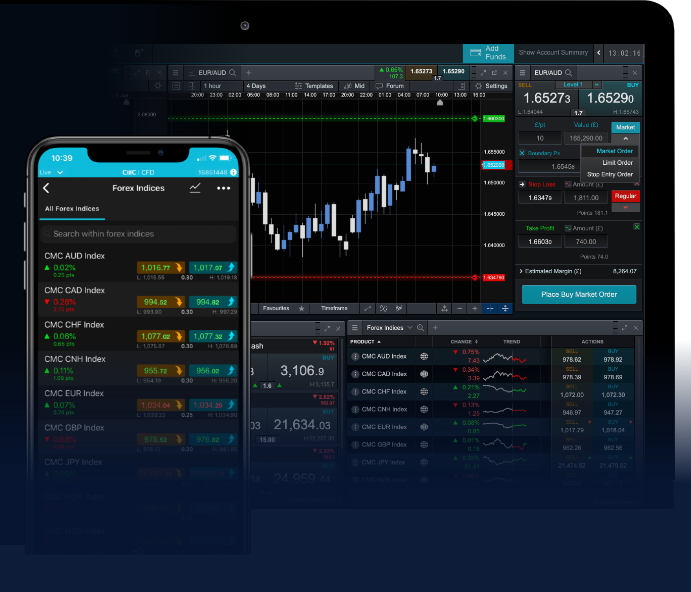

Copy trading is a trading strategy that enables investors to automatically replicate the trades of experienced and successful traders. Using online platforms, investors can select a trader they admire based on their past performance, risk tolerance, and trading style. The selected trader’s trades are then mirrored in the investor’s own accounts, allowing them to gain exposure to the Forex market without the need for extensive research or analysis.

How Does Copy Trading Work?

Copy trading functions through a variety of social trading platforms and brokers that facilitate the connection between traders and investors. Once you create an account on a trading platform, you can browse through a list of traders, often ranked by their performance metrics, risk levels, and trading styles. You can filter through various criteria, such as minimum investment amount, trading frequency, and drawdown levels.

Once you find a trader that suits your preferences, you can start copying their trades. This means that whenever they execute a trade, a proportional trade will automatically be executed in your account, allowing you to mirror their trading decisions in real-time.

Benefits of Copy Trading

There are several advantages associated with copy trading in Forex:

- Accessibility: Copy trading allows individuals with little to no knowledge of the Forex market to engage in trading by tapping into the experience of seasoned traders.

- Time-saving: Investors do not need to spend countless hours analyzing the markets or developing complex trading strategies. Copy trading automates the process.

- Diversification: By following multiple traders, investors can diversify their portfolios, thus spreading risk across different trading strategies and assets.

- Learning Opportunity: Novice traders can learn from experienced traders by observing their strategies and decisions, potentially improving their own trading skills in the process.

Risks Associated with Copy Trading

While copy trading offers numerous benefits, it is essential to consider the associated risks, including:

- Market Risks: The Forex market can be highly volatile, and even successful traders can experience losses. Copying others does not guarantee profits.

- Dependence on Others: Relying solely on other traders can lead to complacency. It’s important to continuously educate oneself and remain informed about market dynamics.

- Lack of Control: When copying trades, you relinquish some control over your trading strategy. Investors should be aware of the trader’s approach and risk tolerance.

How to Choose the Right Trader to Copy

Selecting the right trader to copy is crucial for successful copy trading. Here are some factors to consider:

- Performance History: Review the trader’s historical performance over various time frames (1 month, 6 months, 1 year). Look for consistency rather than spikes in performance.

- Risk Profile: Understand the trader’s approach and risk tolerance. If a trader uses high-risk strategies, it may not align with your investment objectives.

- Trading Style: Different traders have different styles—some are scalpers, while others are long-term investors. Choose a trader whose style resonates with your goals.

- Fees and Costs: Some platforms charge fees for copy trading services, so it’s essential to know the costs involved and how they impact your investments.

- Active Participation: Consider how actively the trader engages in the market. Active traders may respond more quickly to market changes, while passive traders may have longer holding periods.

Getting Started with Copy Trading

To begin your copy trading journey, follow these steps:

- Choose a Trading Platform: Research and select a reputable trading platform that offers copy trading features.

- Create an Account: Sign up and create a trading account on the chosen platform.

- Deposit Funds: Fund your trading account according to the platform’s minimum deposit requirements.

- Browse and Select Traders: Use the platform’s filtering options to find traders that match your investment criteria.

- Allocate Capital: Decide how much capital you want to allocate to each trader. Remember to diversify your investments across multiple traders.

- Monitor Performance: Regularly review your investments and the performance of the traders you are copying. Adjust your strategy as needed.

Conclusion

Copy trading in Forex provides an accessible and effective way for inexperienced traders to engage with the market while benefiting from the expertise of seasoned professionals. By understanding how copy trading works, its advantages and risks, and how to choose the right traders to follow, you can position yourself for potential financial growth. As with any investment strategy, it is crucial to conduct thorough research, remain disciplined, and continuously educate yourself about the Forex market to enhance your chances of success. Start your copy trading journey today, and unlock new avenues for financial freedom!

Deja una respuesta